Deciding Whether to Make a Special Tax 83(b) Election Additionally, the employee must send a copy of the Special Tax 83(b) election form to their employer, and include a copy when filing their yearly income tax return. However, if an employee were to leave the company prior to vesting, he would not be entitled to any refund of taxes previously paid or a tax loss with respect to the stock forfeited.Ī Special Tax 83(b) election must by filed in writing with the Internal Revenue Service (IRS) no later than 30 days after the date of the grant. Subsequent gains or losses of the stock would be capital gains or losses (assuming the stock is held as a capital asset). With a Special Tax 83(b) election, employees are not subject to income tax when the shares vest (regardless of the fair market value at the time of vesting), and they are not subject to further tax until the shares are sold.

In addition to the immediate income inclusion, a Special Tax 83(b) election will cause the stock’s holding period to begin immediately after the award is granted. They will be subject to required tax withholding at the time the restricted stock award shares are received. Employees choosing to make the Special Tax 83(b) election are electing to include the fair market value of the stock at the time of the grant minus the amount paid for the shares (if any) as part of their income (without regard to the restrictions). Under Section 83(b) of the Internal Revenue Code, employees can change the tax treatment of their Restricted Stock Awards. Consult your tax adviser regarding the income tax consequences to you. Upon a later sale of the shares, assuming the employee holds the shares as a capital asset, the employee would recognize capital gain income or loss whether such capital gain would be a short- or long-term gain would depend on the time between the beginning of the holding period at vesting and the date of the subsequent sale.

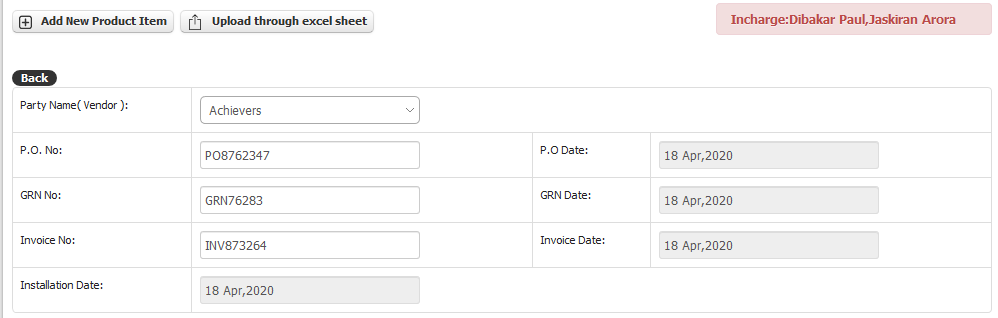

#What is dead stock register plus#

The amount of income subject to tax is the difference between the fair market value of the grant at the time of vesting minus the amount paid for the grant, if any.įor grants that pay in actual shares, the employee’s tax holding period begins at the time of vesting, and the employee’s tax basis is equal to the amount paid for the stock plus the amount included as ordinary compensation income. Instead, the employee is taxed at vesting, when the restrictions lapse. Under normal federal income tax rules, an employee receiving a Restricted Stock Award is not taxed at the time of the grant (assuming no election under Section 83(b) has been made, as discussed below). When a Restricted Stock Award vests, the employee receives the shares of company stock or the cash equivalent (depending on the company’s plan rules) without restriction. Vesting periods for Restricted Stock Awards may be time-based (a stated period from the grant date), or performance-based (often tied to achievement of corporate goals.) If the employee accepts the grant, he may be required to pay the employer a purchase price for the grant.Īfter accepting a grant and providing payment (if applicable) the employee must wait until the grant vests. Once an employee is granted a Restricted Stock Award, the employee must decide whether to accept or decline the grant. How do Restricted Stock Award Plans work? Once the vesting requirements are met, an employee owns the shares outright and may treat them as she would any other share of stock in her account. The restricted period is called a vesting period. A Restricted Stock Award Share is a grant of company stock in which the recipient’s rights in the stock are restricted until the shares vest (or lapse in restrictions).

0 kommentar(er)

0 kommentar(er)